Climate and Weather Risk

We offer tailor-made products and tools to a wide range of clients such as farmer cooperatives, financial institutions, governments, insurers and reinsurers.

Product offering

Satellite-based, scalable and affordable cover for smallholder farmers against drought or other perils.

Tailormade risk transfer solutions that cover and monitor vulnerabilities specific to your particular value chain.

Solutions to provide up-to-date and easy-access insight in the level of exposure for relevant risks of your portfolio.

Parametric insurance

Today, smallholder farmers in developing countries have little or no access to crop insurance that covers yield loss. The traditional yield-based crop insurance relies on on-site loss assessment, which is a logistical and administrative challenge when aimed at smallholder production systems in remote rural areas and increases the cost for the farmer.

Parametric or index insurance addresses these challenges and provides an alternative that covers small holder farmers over vast areas by using satellite technology. This innovative approach to insurance pays out based on a predetermined index that serves as a proxy for loss due to a named peril, such as drought. Since 2009, eLEAF has been developing products that cover drought related crop yield losses in over 18 different countries, covering maize, beans, wheat, coffee, cotton, sesame, sorghum, pasture, and various other crops. Our products are based on our 35+ years database of hourly climate data extending over the whole of Africa and parts of Europe.

Customized Risk Transfer Solutions

There are many ways in which climate related risks can impact agricultural production. Each Agri –business may have value-chain specific vulnerabilities it may want to insure, which require more attention and analysis to come to a suitable parametric insurance product. Or internationally operating financial institutions might wish to monitor climate related risks at a much larger scale, way beyond crop specific insurance. For such clients, eLEAF offers tailor-made risk transfer solutions. These solutions can be embedded in a certain commercial value chain, or comprise of large portfolio level insurance products.

Climate Risk Analysis

Agricultural producers around the globe are looking for solutions to manage and transfer risks, while (re)insurers on the other hand are searching for tools to properly assess complex risks and ways to promptly respond to their clients’ requests.

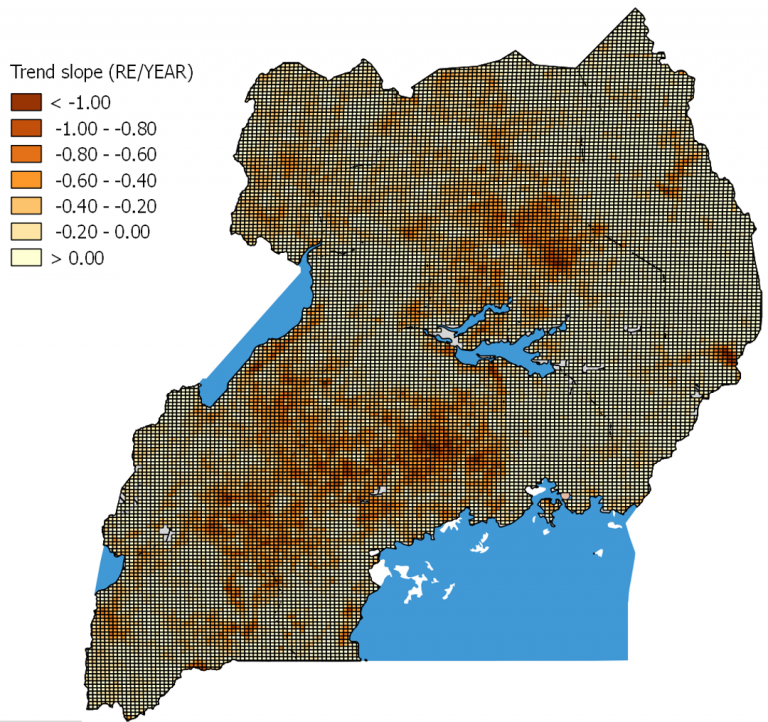

eLEAF’s risk analysis solutions are aimed at clients across the entire agricultural value chain, as well as financial institutions and governments. For any given area we evaluate and monitor the risk of drought, heatwaves, night frost, hail, dry spell, excessive rainfall, and various other climatic parameters. By applying the appropriate metrics and analysis different aspects of each type of risk can be assessed, such as the expected loss, maximum probable loss, the volatility, the long-term trends due to climate change and more.

We offer portfolio-level solutions that can be monitored via our risk monitoring portal that creates up-to-date and easy-access insight in the level of exposure for each relevant risk.

Contact us to see how we can help you manage your risks.

Our partners

eLEAF provides satellite-based data and services for the agricultural, water management and crop index insurance domains. Our product offering is targeted at the entire agri-business value chain ranging from farmers to food processors as well as non-profit organizations, public institutions and governments.