Credit scoring

Insurance against the financial impact of significant crop losses is one vital component of overall risk management.

Credit scoring

Better access to credit leads to increased investment in production through higher quality inputs and better tools. It has proven to improve farmers productivity and strengthen climate resilience and is considered one major prerequisite to help smallholder farmers and remote rural population groups escape the poverty trap.

Yet, these groups have very limited or no access to this much needed finance. Financial service providers are traditionally risk averse and often reluctant deal with the complex, variable and unquantifiable risks associated with agricultural lending to smallholders.

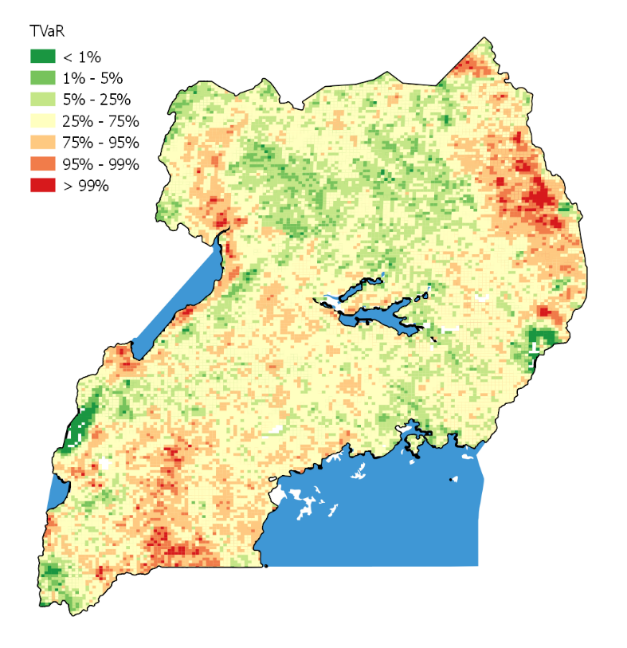

TVarCredit scoring is the primary method in assessing the credit risk on a loan request. This includes determining the financial strength of the borrowers, estimating the probability of default and reducing the risk of nonpayment to an acceptable level. Such risk assessment of borrowers is based on sophisticated statistical analysis of the borrower’s socio-economic profile and, if available, financial records

One of the main risks that farmers face – that is often largely unaccounted for in assessing their credibility– and that directly affects their ability to repay their loans, is the risk associated with agricultural production. As the global climate is changing, weather patterns are also changing. This impact on the frequency and severity of extreme weather events is increasing and consequently also the agricultural production risks.

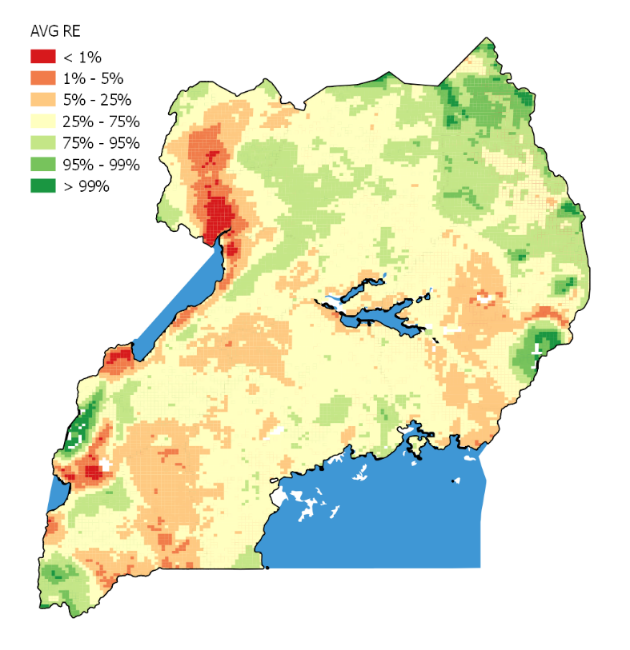

Improved agricultural credit scoring combines traditional credit scoring methods with data about agricultural production risk. In particular the climatic risk: the occurrence of drought, excessive rainfall, high temperatures, hailstorms and frost can be analyzed using remotely sensed data.

eLEAF’s PiMapping data products offer valuable insight to the risk associated with climatic variation and changes. From long timeseries of climate parameters we derive historical seasonal variation, frequency and severity of significant adverse conditions including trends in such events, in order to construct climate risk profile / climate score that can be added to the traditional risk profile for an improved assessment farmers’ credibility.

eLEAF provides satellite based application to various companies

eLEAF provides satellite based applications and data to optimise crop production and water management. Proven by our track record of over 20 years, it doesn’t matter whether you are managing a multinational agro-holding or developing complex water management policies, our state-of-the-art products will provide an extra dimension and support you to optimise your outputs.