Parametric insurance

Insurance against the financial impact of significant crop losses is one vital component of overall risk management.

Crop index insurance

Insurance against the financial impact of significant crop losses is one vital component of overall risk management.

Today, smallholder producers in developing countries have little or no access to such traditional crop insurance, because they are difficult to transfer to remote rural areas and smallholder production systems. There are challenges with data, loss assessment and infrastructure requirements and the administrative capacity within the insurance sector.

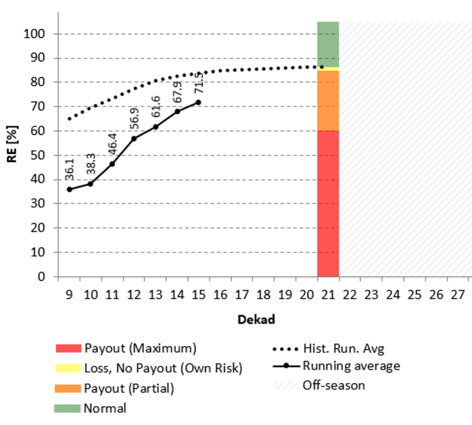

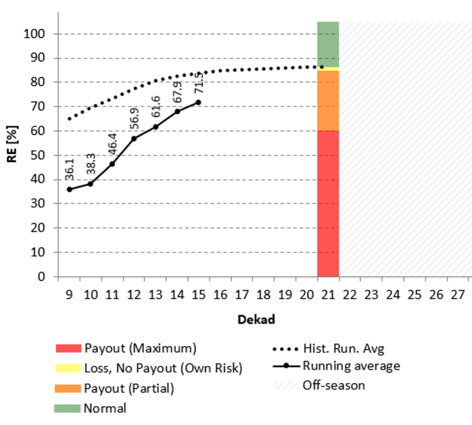

Index insurance provides an alternative that addresses many of these issues. It is an innovative approach to insurance that pays benefits based on a predetermined index, that serves as a proxy for loss.

It allows reliable risk analysis for pricing insurance cover, rapid loss assessment without requiring the services of loss assessors and it is a highly scalable product for insurers

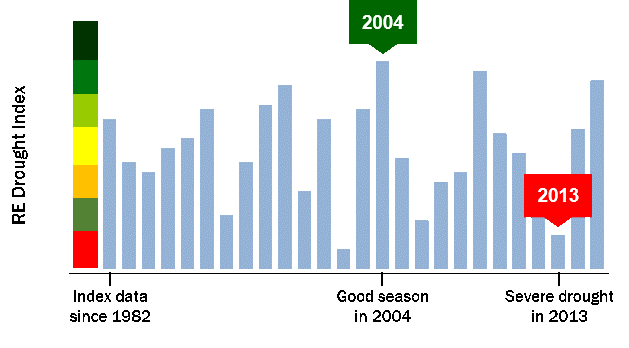

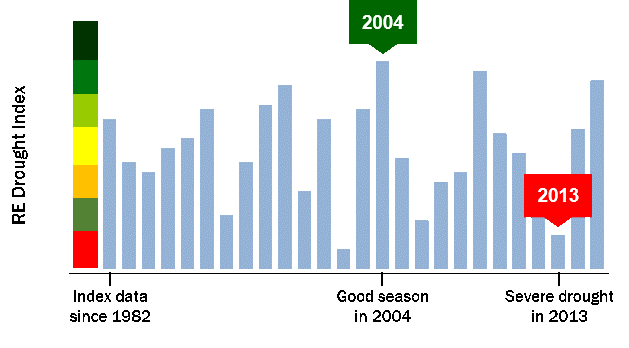

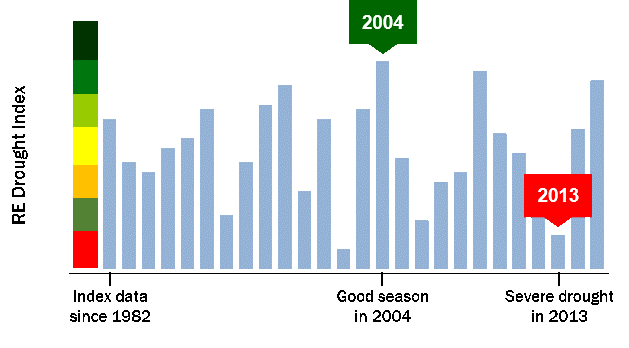

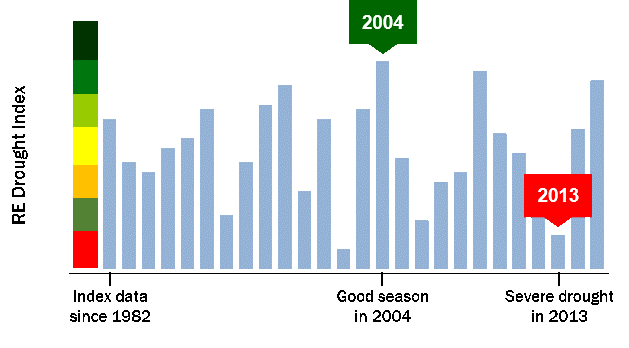

Since 2009, eLEAF has been developing products that cover drought related crop yield losses in over 18 different countries, covering maize, beans, wheat, coffee, cotton, sesame, sorghum, pasture, and various other crops. eLEAF can provide satellite-based indices for various types of insurance such as drought, excessive precipitation, biomass, yield, temperature, vegetation indices, or even sunshine.

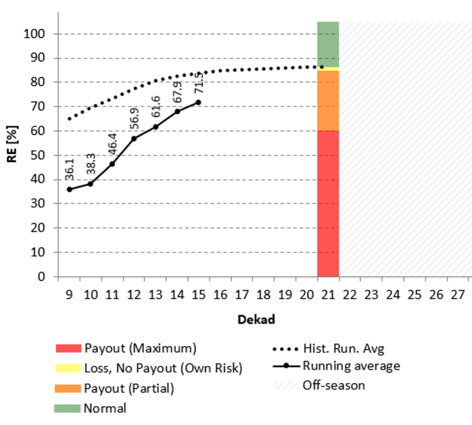

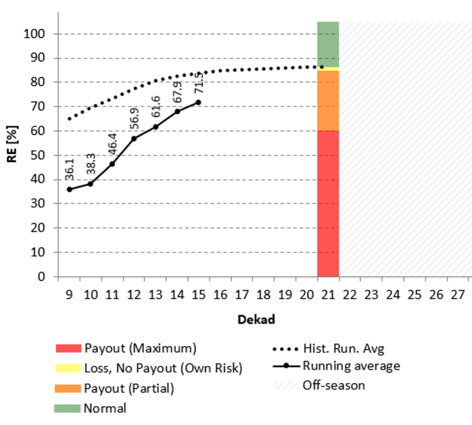

eLEAF offers ready-to-use insurance products, which can be tailored to client’s needs and crop/location specific characteristics. eLEAF’s operational index insurance solution includes risk assessment and index insurance design as well as growing season monitoring and rapid loss assessment.

Insurance is a valuable tool to help farmers become more resilient against weather and climate-related risks

Crop insurance is part of a holistic approach towards financial inclusion, food security and climate resilience. However, smallholder producers in developing countries have little or no access to such traditional crop insurance, because they are difficult to transfer to remote rural areas and smallholder production systems. There are challenges with data, loss assessment and infrastructure requirements and the administrative capacity within the insurance sector.

Parametric Insurance utilizes the strengths of satellite data technology to offer affordable coverage to even the remotest part of the world.

Parametric insurance provides an alternative that addresses many of these issues. It is an innovative approach to insurance that pays benefits based on a predetermined index, that serves as a proxy for loss. That means that farmers are insured against the climatic conditions that cause production loss, not the yield loss itself. It allows reliable risk analysis for pricing insurance cover, rapid loss assessment without requiring the services of loss assessors and it is a highly scalable product for insurers.

Features

Location/zone-tailored settings

Single or multi-phased approach

Flexible pricing

Franchise for avoiding small pay-outs

Statistical analysis for strike/exit

Identification of Start of the Season

Option for Failed Start pay-out

Risk Rate: Average or Weighted Moving Average method

TVaR calculation

Parameter calibration using historic data

eLEAF provides satellite based application to various companies

eLEAF provides satellite based applications and data to optimise crop production and water management. Proven by our track record of over 20 years, it doesn’t matter whether you are managing a multinational agro-holding or developing complex water management policies, our state-of-the-art products will provide an extra dimension and support you to optimise your outputs.