Satellite Based Solutions

eLEAF works on projects that matter.

Our data and applications support clients worldwide to use water sustainably, increase food production and protect environmental systems. We pioneer in operational satellite based solutions, and continuously improve our algorithms to make sure we keep offering cutting-edge and relevant products.

Our services

Learn about crop monitoring, irrigation planning, yield prognosis and sugarcane solutions.

Learn about our evaporation data, water- and irrigation management solutions.

Learn about crop index insurance, credit scoring, claims verification and climate risk analysis.

Our projects on the map

Why Choose Us

Our technology

eLEAF is built on over 20 years of advanced research and we are still developing every day. Our PiMapping® technology provides individual data components quantified per pixel. Various combinations of these data components form client specific information products. This modularity makes eLEAF flexible and our products scalable.

eLEAF’s PiMapping® technology, our data processing infrastructure and our web based platform are developed in-house. This allows us to move with the needs of our client and to integrate other data sources such as in-situ sensors, radar signals or drones and UAVs when relevant. Our continuous innovation agenda will keep us in a pioneering position.

PiMapping® delivers quantified information on crop growth and water use for every pixel on the earth surface, no indices but real numbers.

SEBAL and ET-Look are the core algorithms eLEAF uses to produce PiMapping® data components. Both solve the energy balance at the earth’s surface.

FieldLook puts all the data you need to optimise your yield at your fingertips. Whether you want to keep an eye on your crop from your office desktop.

From our clients

Our latest news

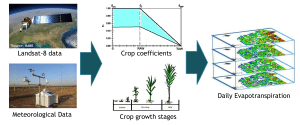

A new approach to estimate daily evapotranspiration, based on Landsat data and FAO56 principles

We are thrilled to share with you a brand new publication, co-authored by our colleague, Abdur Rahim Safi: A new approach to estimate daily evapotranspiration,

Empowering Ugandan Farmers: Innovating Insurance for Resilience

From May 8th to May 12th, we had the privilege of visiting Uganda to witness the impactful project, Index Insurance in Uganda, a real business

eLEAF and RESING sign partner agreement

At SIAM Corné van der Sande from eLEAF and Mohamed Aboufirass from RESING officially signed the Value Added Partner Agreement between the two companies. This way we continue our

Our partners